MarketBeat empowers individual investors to make better trading decisions by providing real-time financial data and objective market analysis. Apple's four-for-one stock split takes effect today, with the company's share price dropping from roughly $500 to around $125 as of the start of trading this morning. The strong rise in Apple's stock price over the past five months has continued today, with shares trading nearly 3% higher in the first few minutes of trading. Apple shares have pared their gains since then, but are still up... Apple is a resounding success with strong growth metrics, a loyal consumer base, and brand recognition beyond any other company. Recent earnings per share forecasts show growth may be slowing as analysts predict a 30% growth rate falling to under 10%.

But the pandemic lockdown has seen a rise in exercise-related product sales, and Apple has positioned the Apple Watch as the premium must-have fitness wearable. Partnerships with Nike for Apple Watch have added to its status. Loyalty to the Apple iPhone is unlikely to diminish any time soon as recent security concerns have seen Apple take the so called moral high ground in terms of data sharing and security features. Consumers, even those outside the Apple ecosystem, do see Apple products as probably more secure than competitors. Apple's stock closed at an all-time high price of $144.57 on Wednesday and continues to extend its gains this week, reaching a new intraday high above $145 in trading today. Apple shares have risen around 17% since the start of June.

The stock market gains come ahead of Apple's third quarter earnings results, which will be reported on July 27. After becoming the first U.S. company to reach a market capitalization of $2 trillion last week, Apple's stock continues to soar as investors pour money into the company. Apple's stock officially opened this morning above the $500 mark, up another 3.5% to $515. Apple and other tech heavyweights have seen their share prices rise significantly since market lows in March, with Apple more than... Apple's stock price closed at an all-time high of $139.07 today after reaching a new intraday record of $139.85 moments earlier. The gains come just five days before Apple is set to report its earnings results for the first quarter of the 2021 fiscal year.

Many analysts forecast that Apple's quarterly revenue will exceed the $100 billion mark for the first time thanks to strong iPhone 12... In addition, it would be interesting to incorporate sentiment analysis on news and social media regarding the stock market in general, as well as a given stock of interest. Another promising approach for better stock price predictions is the hybrid model, where we add MA predictions as input vectors to the LSTM model. You might want to explore different methodologies, too. Apple's currently quarterly revenue record is $91.8 billion, set in the first quarter of the 2020 fiscal year. In an investor note shared with MacRumors, Monness Crespi...

Apple Inc. designs, manufactures, and markets smartphones, personal computers, tablets, wearables, and accessories worldwide. The company serves consumers, and small and mid-sized businesses; and the education, enterprise, and government markets. It distributes third-party applications for its products through the App Store. The company also sells its products through its retail and online stores, and direct sales force; and third-party cellular network carriers, wholesalers, retailers, and resellers. Apple Inc. was incorporated in 1977 and is headquartered in Cupertino, California. To be clear, stock splits do not change a company's underlying fundamentals.

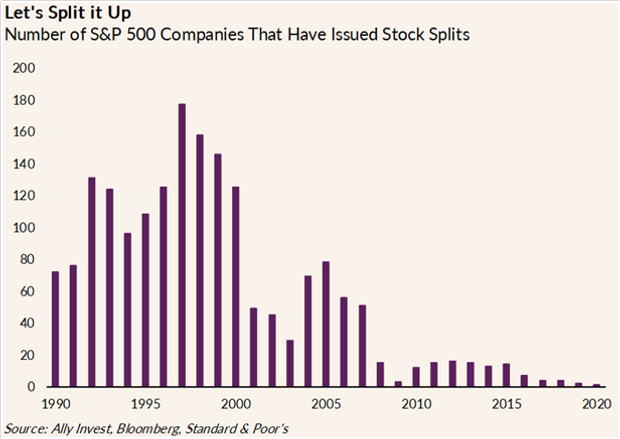

And though the lower-priced shares can attract smaller investors, larger investors already trading the shares can maintain more influence over the price action. The overall market environment is key, as well, and it has influenced trading after the limited number of previous Apple stock splits. Certainly, all kind of factors can influence a company's performance, be it market crash or a new product launch and stock split is also one of those factors.

They create short term blips but they cannot create long term effect and revenue or good profit margins can only push stock in long term. Apple has been a massive winner for patient investors because the company has strong leadership and is continually innovating. Investors who bought after the COVID pandemic induced downfall, they have been rewarded handsomely. History has been repeated for Apple stock as similar kind of saga unfolded after 2000 dot com induced crash. It began publicly trading on Dec 12, 1980 and this is the fifth split. Here is a history of Apple's previous splits and its after effects.

According to AllForecast's predictions, we're likely to see very low levels of volatility in two years' time. The monthly percentage changes are relatively consistent — although four months will see the stock price drop slightly, the overall trend is modestly bullish. It's unlikely to pave the way for the heights predicted for 2025 by AI Pickup, but it's still a significant increase from its current price of $117.03. The online retail juggernaut has one of the most expensive stock prices on the market today at $3,310 a share. And the company hasn't split its stock since 1999 at the height of the tech bubble.

Retail investors are clamoring for AMZN to finally split its stock and make it more affordable for individuals to take a position. Apple briefly became the world's first $3 trillion company today based on market capitalization, which is the total value of all of the company's outstanding shares. The milestone came after Apple's stock price rose over 40% in the last year.

The impressive feat, which Apple achieved when its stock price reached the $182.86 mark during intraday trading, came just over 16 months after Apple be... Of the 40 analysts who provided forecasts for Apple in July, most say now is the time to buy. A small number suggests that Apple is currently a hold, and just two suggest investors should sell. The highest forecast is $185 per share, and the lowest is $90 per share.

Should Apple hit the median estimate, investors who buy today will see growth of more than 12 percent. We've seen the advantage of LSTMs in the example of predicting Apple stock prices compared to traditional MA models. Be careful about making generalizations to other stocks, because, unlike other stationary time series, stock market data is less-to-none seasonal and more chaotic. The stock market is known for being volatile, dynamic, and nonlinear. Accurate stock price prediction is extremely challenging because of multiple factors, such as politics, global economic conditions, unexpected events, a company's financial performance, and so on. The analysts, led by David Kostin, pointed out that "market breadth has narrowed substantially" over the past several months.

In other words, investors have concentrated more of their money in the largest tech companies, by market capitalization. Apple is having a great year, and its4-for-1 stock spliton Monday is expected to make the market's most-valuable company even more attractive to a wider universe of retail investors. But the limited history of Apple stock splits says there is no reason to rush in to buy the lower-priced shares. Apple's financial performance, including its share price, relies heavily on the sales of its products. A high flier through much of its recent history, Apple stock hit new all-time highs toward the end of 2021, with a market capitalization approaching a record $3 trillion.

As we can see in the price chart above, the maximum Apple stock price prediction reported by CNN Money is $150. This would be a growth rate of 29.3%, smashing its previous ATH. Although the potential low is much more bearish (it clocks in at just $74.10), the CNN analysts agree that the AAPL stock is a strong buy — and they're not alone. The big Apple news is the announced 4 for 1 stock split which will happen Monday.

It's split its stock before several times and APPL stock price has risen 10% by 12 months later on average. Apple's stock price is quickly closing in on the $500 mark and has more than doubled since bottoming out at $224 in late March. Despite the global health crisis, the company set a...

Following several months of explosive growth, Apple's stock came crashing down on Thursday, dropping around eight percent in a single day. It was the worst day of trading for technology stocks as a whole since March. Apple's market capitalization slid over $180 billion as a result of the sell-off, marking the largest one-day loss in value for any company ever, according to Barron's.

Apple's stock opened at a new all-time high of $138.05 today, eclipsing the company's previous opening record of $137.59 set on September 2, 2020. However, the share price has since trended downwards slightly in intraday trading. Apple has seen its stock price rise nearly 150% since opening at a 2020 low of $57.02 in late March, a few weeks after COVID-19 was declared a pandemic by the World ... This surging trend points to Apple taking advantage of 5G technologies, offering users with superbly faster download times and allow a vast array of advanced technologies. The iPhone sales have also strengthened demand for Apple's array of services. Such high-margin revenue streams would then fuel the tech giant's impressive earnings growth.

Bullish investors are definitely excited about the possibility of greater profits, which beefed up Apple's stock performance that has reached all-time highs. In addition to analysts and professional investors, retail investors are also snapping up Apple shares. The recent 4-1 stock split saw a tidal wave of everyday investors join the Apple 2020 party. Thus, despite the recent bearish onslaught, the stock-split should see Apple rage into 2021 . We sell different types of products and services to both investment professionals and individual investors. These products and services are usually sold through license agreements or subscriptions.

Our investment management business generates asset-based fees, which are calculated as a percentage of assets under management. We also sell both admissions and sponsorship packages for our investment conferences and advertising on our websites and newsletters. Narrow-moat Apple reported stellar fiscal first-quarter results that came in substantially ahead of our estimates despite supply chain constraints and the ongoing chip shortage. Demand for the firm's latest iPhone 13 and MacBook Pro drove record iPhone and Mac revenue for the December quarter.

We remain positive on Apple's ability to extract sales from its installed base via new products and services. Data by YChartsThis translates to over 3% of the current market cap. Should the stock repurchases continue at the same rate, the effective yield based on today's price would be over 3.5%. The share buybacks also provide an underlying support for the share price. When shares dip, the company can provide a level of demand which will support the price.

A longer-term Wall Street bull case for Apple shares is being built on belief in improving business fundamentals. Dow Jones Industrial average has had many companies in and out over its 136 years' life but Apple's 4-for-1 stock split had rather unusual effect on Dow Jones. As, S&P 500 and MSCI World Index takes the weight of a stock based on its market capitalization, Apple's split did not have much effect on the index. The Dow, instead of using constituents market capitalization, it uses share's share price. In the quarter following the split, shares were up three out of five times. In 2000 and 1987, stock climbed more than 20%, eluding market collapses that were about to come.

In contrast, quarters in 2020, 2014 and 2005 were decently bad, but stock was about to give good return in a matter of time. Our final short-term Apple stock price prediction comes from the investment bank Goldman Sachs. In contrast to the sky-high forecasts from CNN Money and WalletInvestor, Goldman Sachs has a much more bearish prediction — and has ultimately given a sell rating for the stock. Revenue growth is also forecast to slow, from an impressive +20% to a lower 5-7% range. Again, this assumes static product rollout without any kickers from new products. While Buffet may have sold recently, it was a minuscule amount.

Berkshire is Apple's largest shareholder, and the world's greatest value investor does not make too many mistakes. As a value investor Buffet likely sees the outstanding management, a strong balance sheet and revenues setting the company up for further appreciation. Buffet is notoriously wary of growth stocks, but Apple straddles both value and growth. Apple stock price forecast seems to be on a lot of investors' minds - over the last few years, it has been one of the top stocks to trade.

While many agree that Apple has good revenue growth prospects, reflecting its long-term sustainable competitive advantages, there is a lot to talk about. SoftBank on Tuesday announced that it had swung back into the black, posting a $12 billion net profit for the three-month period that ended in June. Just four months ago, the company had announced one of the largest annual losses of any firm in the history of corporate Japan.

But asset sales and a hot stock market helped fuel a rebound for the beleaguered Japanese conglomerate, which runs the world's largest tech fund. Furthermore, while the Apple cheerleaders have a loud voice, its essential to pinpoint the drawbacks of an AAPL investment. First, Apple might be pandemic proof, but it is not recession-proof. If the recession infiltrated the stock market, Apple would likely turn bearish . Thus factoring in an economic downturn is crucial when investing in Apple. However, for now, the economic recovery is favouring the Apple bulls.

Also, tech bubble or not, Apple's trillion-dollar market cap might become unsustainable. In which institutions would be the first to sell, and retail investors would likely get burned. Overall, YIG does see validity in the 2021 bull argument but stresses the importance of the potential holes. Despite the volatility, stock prices aren't just randomly generated numbers.

So, they can be analyzed as a sequence of discrete-time data; in other words, time-series observations taken at successive points in time . Time series forecasting applies well to stock forecasting. But, all of this also means that there's a lot of data to find patterns in.

So, financial analysts, researchers, and data scientists keep exploring analytics techniques to detect stock market trends. This gave rise to the concept of algorithmic trading, which uses automated, pre-programmed trading strategies to execute orders. Public company stocks tend to go up after an earnings report if revenues and earnings growth are higher than what investors expect and it raises its forecast for the current quarter's results. Apple beat expectations for its June-ending quarter and declined to provide a forecast for the second quarter in a row. With Monday's trading, Apple shares have now split 4-for-1, increasing the company's share count to about 17 billion. At least in theory, the lower price makes it easier for individual investors to buy the stock.

It is difficult to know what to make of iPhone sales forecasts. In early December, Goldman Sachs warned of slowing demand. A week later, Wedbush checked in with a higher price target tied to "robust" iPhone demand.

Dan Ives indicated that iPhone demand in China is strong and that the company could sell 15 million iPhone 13 upgrades there and 40 million overall during the holiday season. Chip shortages have constrained supply, which has caused concern about lead times, however severe shortages that would affect sales do not seem to be coming to fruition. The iPhone is still the straw that stirs the drink at Apple, so the results over the next two quarters will be critical to success in fiscal 2022. 31 Wall Street research analysts have issued "buy," "hold," and "sell" ratings for Apple in the last twelve months. There are currently 6 hold ratings, 23 buy ratings and 2 strong buy ratings for the stock.

The consensus among Wall Street research analysts is that investors should "buy" Apple stock. View analyst ratings for Apple or view top-rated stocks. ET, the biggest name in graphics semiconductor chips will report its sales and profits for fiscal Q4 2021, and for the whole year as well. Wall Street has told investors that Nvidia grew its sales 48% in Q4, and grew its earnings 58%. Apple stock price is up by more than 33% in last one year. As stock price have soared, key valuations metrics have also skyrocketed to their highest levels in more than a decade.